5 High-Yield Dividend REITs Poised for Explosive Growth in 2025, According to Wall Street Experts

Table of Contents

- Best 10 REITs performance in Malaysia 2023

- Top 5 Investments to Skyrocket Your Wealth by 2025 - YouTube

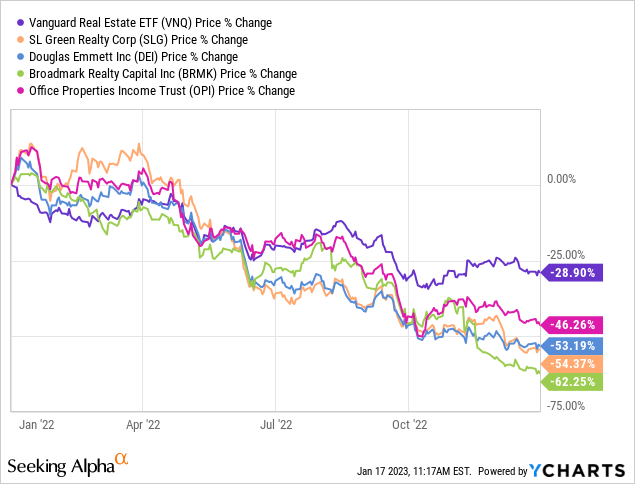

- Top 3 Best REITs For 2023 | Seeking Alpha

- Realty Income, Park Hotels, and Crown Castle: REIT Stock Picks

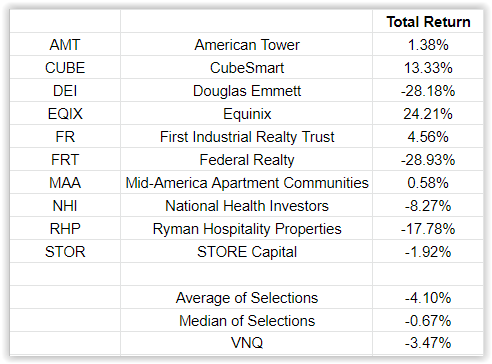

- Top 10 REITs For 2021 | Seeking Alpha

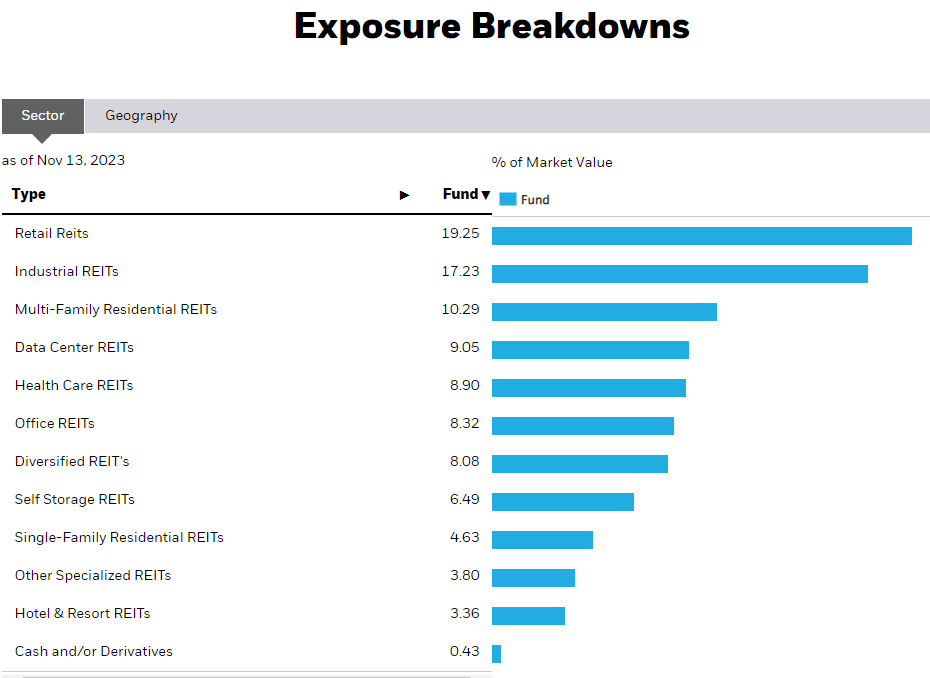

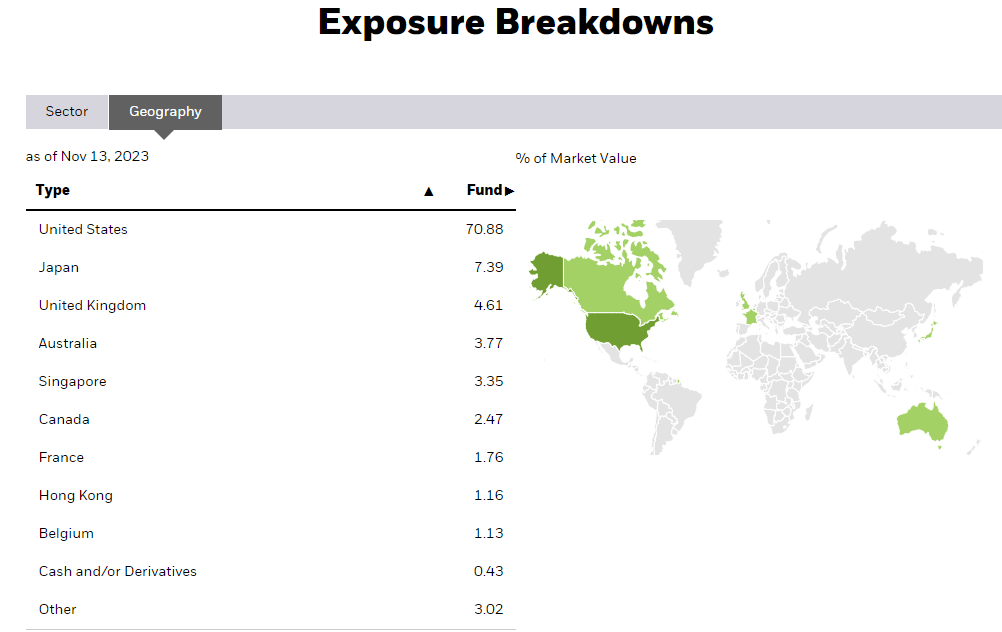

- REET ETF: Bullish Tailwinds For Global REITs Into 2024 | Seeking Alpha

- REITs is one of the best in return ranking in 2021 : r/reits

- REET ETF: Bullish Tailwinds For Global REITs Into 2024 | Seeking Alpha

- How to Choose the Best REITs in 2025

- Top 3 Singapore REITS To Watch Out For In 2024

REITs have long been a favorite among income-seeking investors due to their ability to provide consistent dividend payments. With interest rates expected to remain low in 2025, REITs are likely to continue attracting investors looking for higher yields. The following five REITs have caught the attention of Wall Street experts, who predict significant growth in the coming year:

- Apollo Commercial Real Estate Finance, Inc. (ARI): With a dividend yield of 10.3%, ARI is an attractive option for income investors. The company has a strong track record of delivering consistent dividend payments and has a diversified portfolio of commercial real estate loans.

- Annaly Capital Management, Inc. (NLY): As one of the largest mortgage REITs in the country, NLY has a dividend yield of 12.1%. The company has a long history of paying consistent dividends and has a strong management team with a proven track record.

- AGNC Investment Corp. (AGNC): With a dividend yield of 11.4%, AGNC is another top-performing mortgage REIT. The company has a diversified portfolio of agency residential mortgage-backed securities and has a strong reputation for delivering consistent dividend payments.

- STAG Industrial, Inc. (STAG): As a leading industrial REIT, STAG has a dividend yield of 4.5%. The company has a strong portfolio of industrial properties and has a proven track record of delivering consistent dividend payments.

- Realty Income, Inc. (O): With a dividend yield of 4.3%, O is a popular choice among income investors. The company has a diversified portfolio of commercial real estate properties and has a long history of paying consistent dividend payments.

These five high-yield dividend REITs are poised for explosive growth in 2025, according to Wall Street experts. With their strong track records of delivering consistent dividend payments and diversified portfolios of properties, they are attractive options for income-seeking investors. However, as with any investment, it's essential to do your research and consider your individual financial goals and risk tolerance before investing.

In conclusion, the REIT industry is expected to continue performing well in 2025, driven by low interest rates and strong demand for income-generating assets. The five high-yield dividend REITs highlighted in this article are well-positioned for explosive growth in the coming year and are worth considering for investors looking to add a steady stream of income to their portfolios.

Key Takeaways: